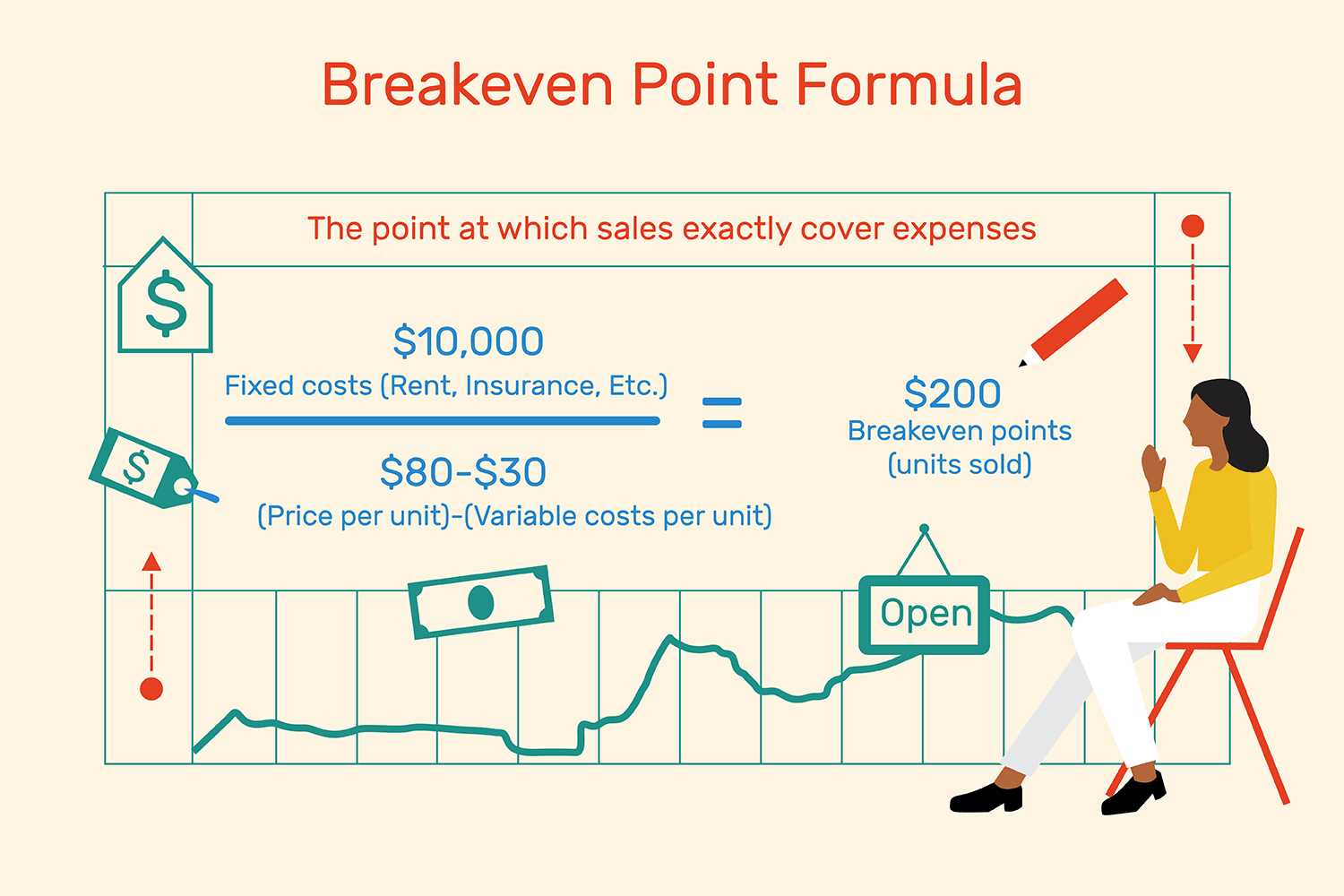

Break-even analysis calculates the volume of production at a given price necessary to cover all costs. It can be viewed graphically or with simple mathematics. The Break-even Point defines when an investment will generate a positive return. The relationship between fixed costs, variable costs and returnsīreak-even analysis is a useful tool to study the relationship between fixed costs, variable costs and returns. The area below the BEP is construed as loss to the organisation as the total cost is higher than the total revenue and the area above the BEP point is construed as profit to the organisation, as total revenue curve is higher than the total cost curve. But at one point the total cost and the total revenue meet together, the point is called breakeven point which means the point where there is no profit no loss to the organisation.

With the increase in the production or output, the total cost is raised and the total revenue is also gained at the same time.

#Break even graph plus#

The TC (total cost) curve started at the point of FC curve as total cost includes fixed cost plus variable cost. The FC (fixed cost) curve is drawn parallelly about the x-axis, as fixed cost will be constant and it will be incurred even when there is no production, but fixed cost won't be raised with the increase in production. However the total revenue increases with the increase in the production or out, as such the TR curve is drawn up from left to right. The TR (total revenue) curve started at zero as there won't be any income when there is zero production. X-axis of the graph represents the output and the Y axis of the graph represents cost / revenue and price. The above graph explains what is breakeven point and how the producers reach or arrive at breakeven point which is also otherwise called as no profit and no loss situation. For a Put, it is the strike price minus the premium paid. For a Call, it is the strike price plus the premium paid. In options, the Break-even Point is the market price that a stock must reach for option buyers to avoid a loss if they exercise. The Break-even method can be applied to a product, an investment, or the entire company's operations and is also used in the options world. And finally it does not provide a return on your investment (the reward for exposure to risk).

Also it does not build up a reserve for future losses. This is important for anyone that manages a business, since the break-even point is the lower limit of profit when prices are set and margins are determined.Īchieving Break-even today does not return the losses occurred in the past. There is no profit made or loss incurred at the break-even point. or also the point where total costs equal total revenues. The point where sales or revenues equal expenses. A break-even point defines when an investment will generate a positive return. The Break-even Point is, in general, the point at which the gains equal the losses.

0 kommentar(er)

0 kommentar(er)